.png?width=1584&height=396&name=LinkedIn%20Cover%20Photo%20(5).png)

Whether you are a business owner or you have worked in finance, you are likely familiar with filing IRS 1099 forms. But with tax season only happening once a year, gathering the information that you need to file these forms can be a bit overwhelming. This article is designed to give you most of the information that you need in one place to hopefully make this process a little easier for you.

What’s New?

In past years, non-employee compensation would be included under box 7 of the 1099-MISC form. Any non-employee compensation will be recorded on a separate form called 1099-NEC. There are no updates to the 1099-NEC for 2022. What's new on the 1099-MISC?

-

- Box 13 – Box 13 has been assigned to the Foreign Account Tax Compliance Act (FATCA) filing requirement check box.

- Box 13 through 18 – These boxes have been renumbered respectively.

Note: See below to learn more about how AIOA can help.

What You Need to Know

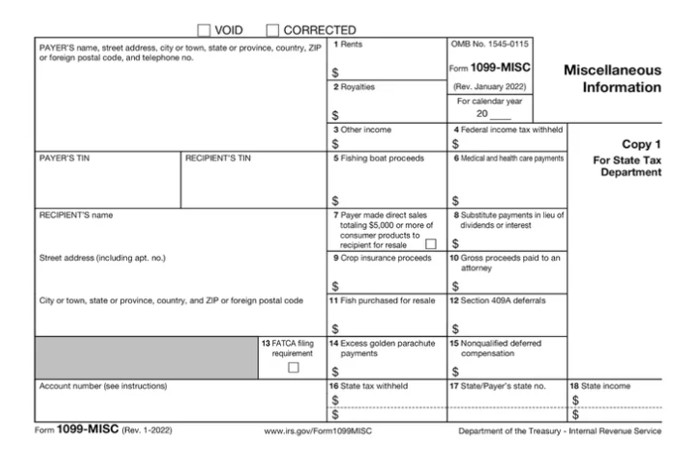

Form 1099-Misc

This form should be filed for each person whom you paid either at least $10 in royalties or broker payments in lieu of dividends or tax exempt interest; or at least $600 during the year for the following:

-

- Rents (box 1)

- Prizes and awards (box 3)

- Other income payments (box 3)

- Cash paid from notional principal contract to an individual, partnership, or estate (box 3)

- Any fishing boat proceeds (box 5)

- Medical and health care payments (box 6)

- Crop insurance proceeds (box 9)

- Gross proceeds paid to an attorney (box 10)

-

- Made in the course of trade or business in connection with legal services, but not for the attorney's services, for example, as in a settlement agreement

- Are not reportable by you in box 1 of Form 1099-NEC

-

- Section 409A deferrals (box 12)

- Nonqualified deferred compensation (box 14)

1099-MISC date is 1/31/2023 unless amounts are reported in boxes 8 or 10 then it is 2/15/23. Paper file with IRS by 2/28/2023 OR E-File with the IRS by 3/31/2023.

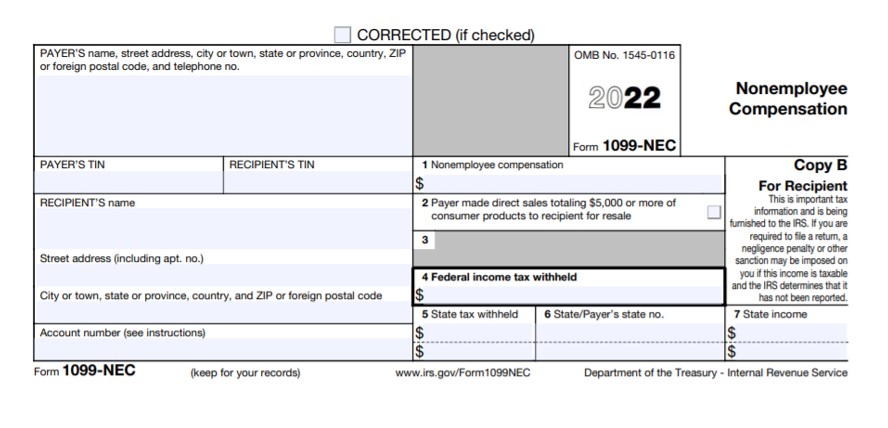

Form 1099-NEC

This form should be filed for each person in the course of your business to whom you paid during the year at least $600 in the following:

-

- Services performed by someone who is not your employee (including parts and materials, if included in the total payment. If broken out on invoice do not need to include on 1099) (box 1)

- Payments to an attorney (box 1)

- You must also file Form 1099-NEC for each person from whom you have withheld any federal income tax (report in box 4) under the backup withholding rules regardless of the amount of the payment.

The 1099-NEC form must be furnished to the payee AND filed with the IRS by 1/31/2023.

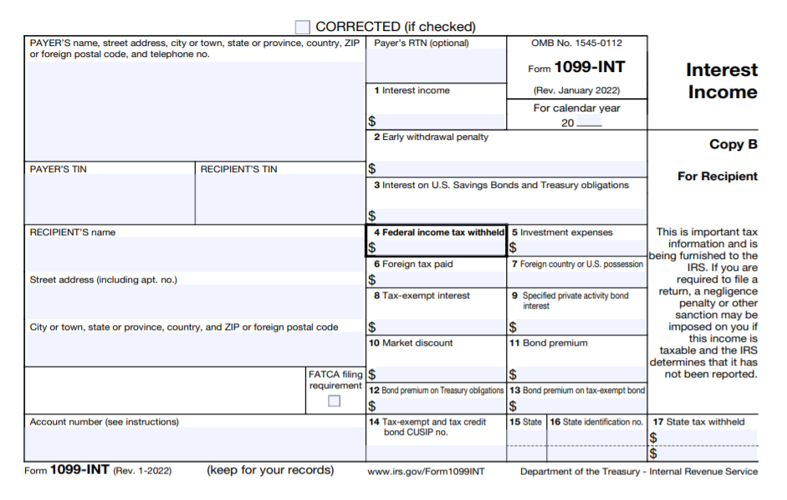

Form 1099-INT

File Form 1099-INT, Interest Income, for each person:

-

- To whom you paid amounts reportable in boxes 1 (interest income), 3 (interest on US Savings Bonds and Treasury Obligations), and 8 (tax exempt interest) of at least $10 (or at least $600 of interest paid in the course of your trade or business described in the instructions for Box 1)

- For whom you withheld and paid any foreign tax on interest; or

- From whom you withheld (and did not refund) any federal income tax under the backup withholding rules regardless of the amount of the payment.

Report only interest payments made in the course of your trade or business including federal, state, and local government agencies and activities deemed nonprofit, or for which you were a nominee/middleman.

Other Common 1099 Forms

-

- 1099-A – Acquisition or Abandonment of Secured Property

- 1099-C – Cancellation of Debt (issued by the creditor)

- 1099-S – Proceeds from real estate transactions

- 1099-K – Merchant Card and Third Party Network Payments

- 1099-B – Proceeds from Broker and Barter Exchange transactions

- 1099-DIV – Dividends and Distributions

- 1099-R – Distributions from Pensions, Annuities, IRA, Insurance contracts

- 1099-Q – Distributions from Qualified Education Programs (i.e., 529)

- 1099-G – Certain Government Payments (i.e., state income tax refunds)

- 1099-OID – Original Issue Discount

- 1099-PATR – Taxable Distributions from cooperatives

It is important to note that there are some common causes of confusion with Forms 1099-B, 1099-K, and 1099-DIV. The 1099-B form is not applicable to barter transactions between two business owners and this form is issued by the exchange or brokerage firm. The 1099-K form comes from the merchant service company. For this reason, we do not include vendor payments made by credit cards on the 1099-Misc form. The 1099-DIV form is not intended to report distributions paid by S-Corps or Partnerships. It also does not cover interest labeled as dividends (i.e., a credit union account paying interest on deposit accounts). It is most commonly used to record investments paying cash dividends that are not part of a regulated fund.

Form 1099 Exemptions

You do not need to file a 1099 form for any of the following expenses:

-

- Payments made to corporations

- Wages paid to employees

- Expenses with receipts

- Payments to tax exempt organizations

-

- LLCs that file as S or C corps

- LLCs that file as S or C corps

Non-Compliant Subcontractors

If you are unable to obtain a W9 form from a subcontractor, the IRS recommends that you follow these steps:

-

- First request for W9 must have been made by 12/31/2022

- File the 1099 leaving the EIN/SSN box blank (you may need to file on paper). Some Efile websites will allow you to files with 0's for TIN.

- When mismatch notice is received from the IRS, forward to subcontractor along with back up withholding notice.

What if you miss the filing deadline?

For businesses with gross receipts over $5 million, the penalties for late filing are highlighted below:

-

- $50/return within 30 days ($571,000 maximum)

- $110/return through 8/1/23 ($1,713,000 maximum)

- $280/return after 8/1/23 or not at all ($3,426,000 maximum)

- $570/return for intentional disregard (no limitations)

Penalties for businesses with gross receipts under $5 million:

-

- $50/return within 30 days ($199,500 maximum)

- $110/return through 8/1/21 ($571,000 maximum)

- $270/return after 8/1/21 or not at all ($1,142,000 maximum)

- $570/return for intentional disregard (no limitations)

Common E-Filing Services

You are eligible to start E-filing on 1/1/23. Here are some services to consider:

How We Can Help

As filing 1099s can be time consuming, the team at All in One Accounting happily assists its clients in this process so that they can continue to focus on making sure their business is running smoothly and efficiently.

We follow a simple process to make sure that the 1099 forms are accurate and filed on time as outlined below:

-

- Extract data from the accounting system by pulling a 1099 report/vendor transaction list

- Identify those paid more than $600 ($10) in total for the year

- Verify or obtain copies of W9s

- Enter data into e-filing system

- Save forms in our system

Below are the following 1099 forms that we prepare for clients:

-

- 1099-NEC

- 1099-MISC

- 1099-INT

Click here for more information on 1099s and how we can help your business.

At All In One Accounting, we take businesses from financial chaos to business clarity and beyond. Our elite team of Accountants, Controllers and CFOs are ready to help you in these uncertain times. Click here for a FREE consultation with one of our accounting professionals.