Succession planning, and managing growth continue to be strong priorities for many family-owned businesses, according to a 2021 North American report of the 10th Global Family Business Survey, conducted by PwC Global. When asked to name their top priorities for the next two years, 57% surveyed listed new market expansion and client segmenting as a top priority, and 50% were concerned about introducing new products or services. One Minnesota business, family-owned and operated over multiple decades, faced this challenge as they began transitioning operations from the founders to the next-generation whose main priority was growth. Here are the highlights!

Succession planning, and managing growth continue to be strong priorities for many family-owned businesses, according to a 2021 North American report of the 10th Global Family Business Survey, conducted by PwC Global. When asked to name their top priorities for the next two years, 57% surveyed listed new market expansion and client segmenting as a top priority, and 50% were concerned about introducing new products or services. One Minnesota business, family-owned and operated over multiple decades, faced this challenge as they began transitioning operations from the founders to the next-generation whose main priority was growth. Here are the highlights!

A Frank Assessment of the Business

The family long understood the incredibly complex nature of their business when it came to its accounting practices. Their commercial business operated as the dealer, service, installer, and fabricator supplying industry leading commercial products to customers in the Twin Cities, upper Midwest, and nationwide via eCommerce. There were a lot of moving parts; depending on the manufacturer or reseller, the accounting process would change. The family recognized that to continue moving forward, they needed to make better data driven decisions, but were lacking proper insight to forecast and better predict the market. This discrepancy thwarted the family's ability to make decisions, promote growth, and plan appropriate rightsizing as required, among other key drivers.

|

|

|

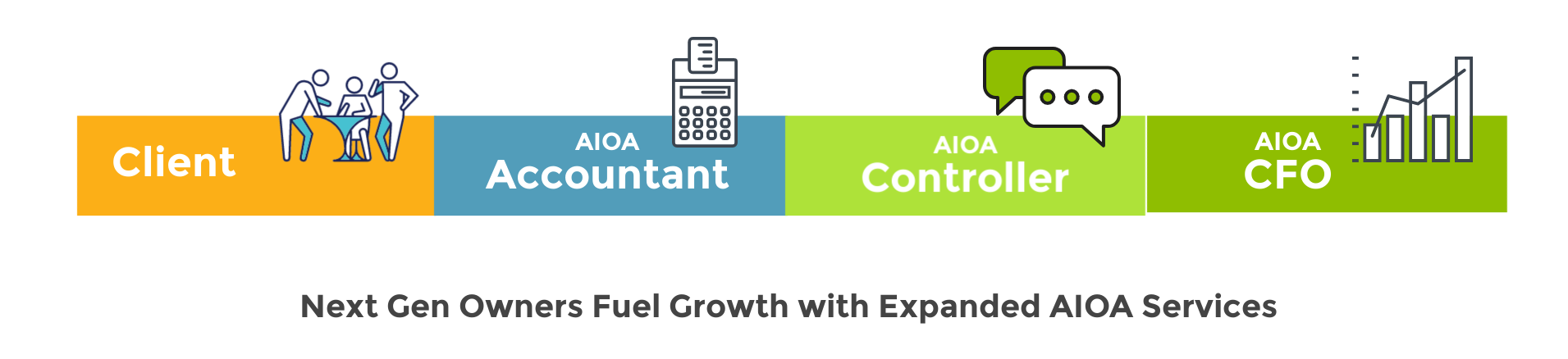

Addressing Immediate Accounting Needs The family also needed to obtain accounting services as their bookkeeper was retiring. They were beginning to take on more complicated clients and projects, and they needed more complex accounting help. All In One Accounting (AIOA) was referred by their banking partner. First step, the family engaged an AIOA Accountant to handle the immediate needs of managing the books and day-to-day financial operations, and to shore up and adjust their accounting practices. |

|

Adding Another Level of Oversight Once stability was achieved, they met with AIOA to assess next steps in building their financial systems and decided to engage an AIOA Controller. The Controller helped the family gain better understanding of their P & L, balance sheets, and profits margins, and more.

|

|

|

Managing for Growth From there, as the company’s growth led to new investments, including manufacturing, they knew they needed more specialized financial services expertise. They extended their contract with AIOA to include CFO services. A CFO with experience in a similar industry was assigned, helping ensure a quick and seamless transition. The AIOA CFO provided instant and relevant data to act on for results, helping alleviate the stressors their complicated billing process brought, and identify risky gaps. The results were, in the owner's words, game changing outcomes for their financial health and future. |

Read the Full Case Study!

This is a timely read for businesses who are handing the business off to the next generation of owners. It highlights the benefits of adding expert financial help at the critical junctures of business growth, and provides more specifics on their results. Click the button to download the full case study, for a one page representation of the graphic above with case study details, click here.

Want to access all of our case studies? Visit here. At All In One Accounting, we take businesses from financial chaos to business clarity and beyond. Contact us for a free consultation with one of our accounting professionals.

SOURCE: PwC Global Family Business Survey 2021; © 2021 Pwc.com